Defensive Strategies in Fraudulent Conveyance Litigation

This Article examines the procedural and substantive defenses available to transferees in fraudulent conveyance actions under Polish civil law, with particular emphasis on the actio Pauliana codified in Articles 527–534 of the Polish Civil Code. Drawing upon statutory analysis and judicial interpretation, this Article constructs a comprehensive taxonomy of defensive strategies, ranging from threshold jurisdictional challenges to affirmative defenses grounded in equitable principles. The analysis demonstrates that defendants possess substantial tools to contest fraudulent transfer claims, provided they engage in proactive litigation strategy and maintain rigorous attention to procedural requirements.

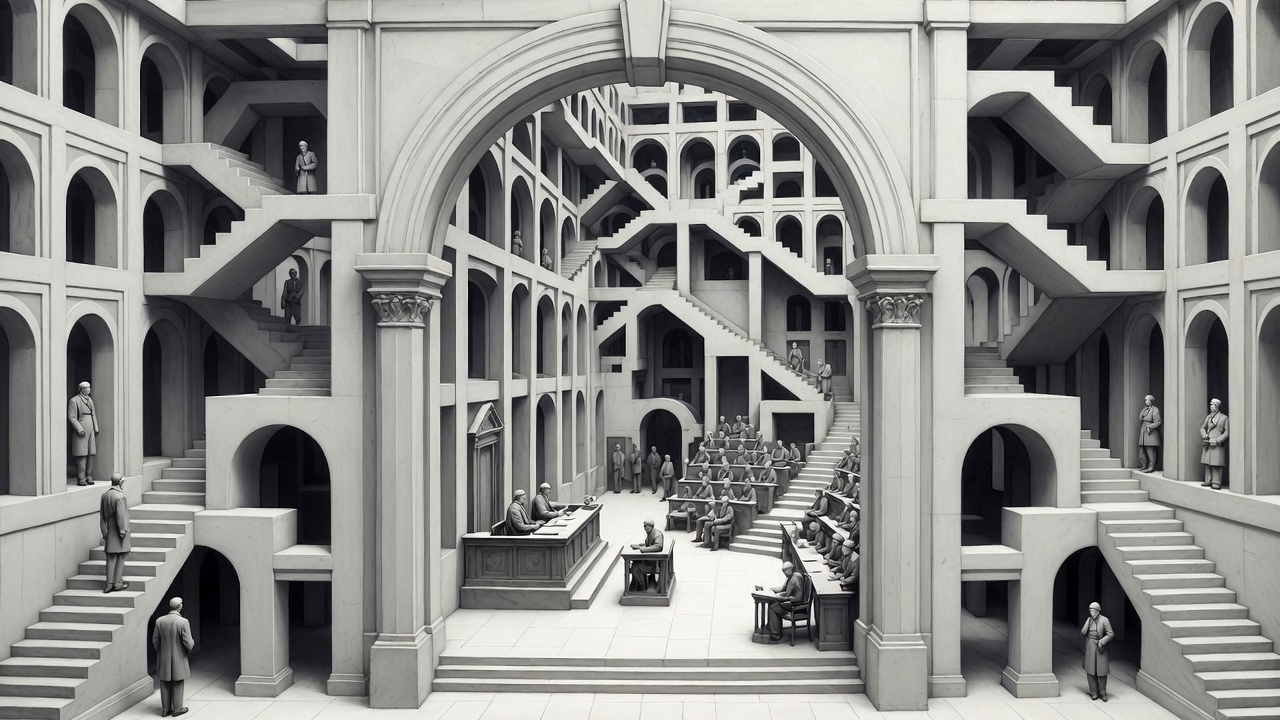

I. Introduction

The actio Pauliana—a creditor’s remedy of venerable Roman lineage—operates as a significant constraint upon the ordinary principle that obligational rights bind only the immediate parties thereto. When a debtor conveys assets with the effect of rendering himself judgment-proof, the law permits aggrieved creditors to pursue the transferred property into the hands of third-party recipients. Yet this extraordinary remedy, precisely because it disrupts settled transactions and imposes liability upon parties who may have dealt at arm’s length and in good faith, demands rigorous adherence to statutory prerequisites.

For the defendant-transferee, a fraudulent conveyance complaint represents not merely a legal inconvenience but a genuine threat to property rights acquired through ostensibly valid transactions. The prospect of disgorging assets—perhaps a family residence received by gift or commercial property purchased for fair value—concentrates the mind wonderfully on questions of procedural and substantive defense.

This Article proceeds from the premise that effective defense counsel must approach actio Pauliana litigation with systematic attention to the plaintiff-creditor’s burden of proof. The statutory framework imposes upon the creditor the obligation to establish, cumulatively, a series of demanding elements. The defendant’s task, accordingly, lies in identifying and exploiting weaknesses in any link of this evidentiary chain.

II. The Creditor’s Prima Facie Case: Elements and Vulnerabilities

Before examining specific defensive strategies, one must appreciate the architecture of the creditor’s claim. Under Article 527 of the Civil Code, the plaintiff must demonstrate:

- The existence of a valid, enforceable claim against the debtor;

- The debtor’s execution of a juridical act (such as a conveyance or gift);

- Resulting prejudice to the creditor through the debtor’s insolvency or deepened insolvency;

- The transferee’s acquisition of an economic benefit;

- The debtor’s subjective awareness that the transaction would prejudice creditors; and

- The transferee’s knowledge of such awareness, or circumstances under which reasonable diligence would have revealed it.

Each element presents an axis along which the defense may mount a challenge. The following sections examine the most potent defensive strategies in descending order of procedural economy.

III. The Limitations Defense: Article 534 and the Five-Year Bar

A. Statutory Framework

Perhaps no defense offers greater efficiency than the statute of limitations. Article 534 of the Civil Code establishes that a creditor’s right to seek avoidance expires five years from the date of the impugned transaction. This period constitutes a terminus praeclusionis—a preclusive deadline whose passage extinguishes the substantive right rather than merely barring procedural recourse.

B. Practical Application

The limitations period commences upon the perfection of the challenged conveyance—typically the date of contract execution or, in real property transactions, the date of registration in the land registry. Critically, the statutory clock runs from the objective date of transaction, not from the creditor’s subjective discovery thereof. A creditor who remains ignorant of the conveyance for six years cannot resurrect an expired claim by pleading excusable delay.

C. Procedural Considerations

Defense counsel must appreciate that Polish courts do not raise the limitations bar sua sponte. The defendant bears the burden of affirmatively pleading this defense, optimally in the initial responsive pleading. Failure to assert the defense in timely fashion may result in its waiver—a catastrophic oversight given that, where applicable, it provides complete immunity from liability.

IV. Challenging the Underlying Obligation

A. The Nexus Between Claim Validity and Fraudulent Transfer Liability

The actio Pauliana exists solely to facilitate satisfaction of legitimate creditor claims. It follows, a fortiori, that where no valid underlying obligation exists, the entire edifice of fraudulent transfer liability collapses. The defendant may therefore mount a collateral attack upon the creditor’s asserted claim against the debtor.

B. Grounds for Challenge

Several avenues merit exploration:

Contractual Invalidity. If the agreement purportedly giving rise to the creditor’s claim suffers from formation defects—absence of consideration, failure to satisfy formal requirements, or vitiating factors such as fraud or duress—the claim lacks juridical foundation.

Prior Satisfaction. The defendant may demonstrate that the obligation has been discharged through performance, accord and satisfaction, or release. Evidence of payment, set-off, or novation negates the creditor’s standing.

Unenforceability. Even where an obligation technically exists, it may be unenforceable. A time-barred debt, for instance, cannot support an actio Pauliana because the creditor lacks the legal capacity to compel satisfaction from the debtor’s assets—and a fortiori from those of third parties.

C. Strategic Considerations

This defense proves particularly potent where the creditor proceeds without first obtaining judgment against the debtor. In such circumstances, the defendant enjoys full scope to litigate the validity and quantum of the underlying claim as a threshold matter. Where the creditor possesses a prior judgment, collateral attack becomes substantially more constrained, though not entirely foreclosed.

V. Negating Creditor Prejudice: The Solvency Defense

A. The Temporal Dimension of Prejudice

Article 527 § 2 defines creditor prejudice through the lens of debtor insolvency—either the transaction rendered the debtor insolvent or deepened a pre-existing insolvency. Crucially, Polish jurisprudence has consistently held that prejudice must be assessed as of the date of judgment, not as of the date of the challenged transaction. This temporal framework creates significant defensive opportunities.

B. Demonstrating Adequate Debtor Assets

The defendant may defeat the prejudice element by establishing that the debtor possesses sufficient assets to satisfy the creditor’s claim in full. Relevant evidence includes:

- Real property holdings beyond the transferred asset;

- Motor vehicles, equipment, or other tangible personalty;

- Accounts receivable or other choses in action;

- Equity interests in business entities;

- Regular employment income amenable to garnishment.

If the debtor’s remaining estate suffices to make the creditor whole, the challenged transaction—whatever the parties’ subjective intentions—cannot have caused legally cognizable prejudice.

C. The Security Interest Defense

Where the creditor holds a mortgage, pledge, or other security interest upon debtor property of adequate value to secure the obligation, the creditor’s interest is already protected. Judicial economy and equitable principles counsel against permitting such a creditor to pursue fraudulent transfer remedies when conventional enforcement mechanisms provide full relief.

D. Equivalence of Consideration

A transaction for fair value, where the debtor received and retained an equivalent economic benefit, does not diminish the debtor’s net worth available to creditors. If the defendant purchased property at arm’s length for market-rate consideration, and the debtor either retained those proceeds or applied them to satisfy other obligations, the causal nexus between the transaction and the debtor’s insolvency is severed.

VI. Rebutting Statutory Presumptions of Transferee Knowledge

A. The Presumption Applicable to Close Relations

Article 527 § 3 establishes a rebuttable presumption that a transferee standing in a “close relationship” with the debtor possessed knowledge of the debtor’s fraudulent intent. The statutory concept of “close relationship” encompasses not merely consanguinity or affinity but any factual relationship of sufficient intimacy to permit inference of financial transparency between the parties.

B. Rebuttal Strategies

The presumption, though potent, remains defeasible. The defendant must adduce evidence demonstrating the absence of actual knowledge and the impossibility of acquiring such knowledge through reasonable diligence. Relevant considerations include:

- Geographic separation limiting regular contact;

- Infrequency of communication or visits;

- Absence of discussions concerning financial matters;

- The nature of the relationship (a daughter-in-law’s relationship with her father-in-law, for instance, typically involves less financial intimacy than a parent-child relationship);

- The defendant’s independent circumstances suggesting no occasion to inquire into the transferor’s solvency.

C. The Business Counterparty Presumption

Article 527 § 4 creates a parallel presumption applicable to entrepreneurs maintaining “stable business relations” with the debtor. This presumption rests upon the premise that ongoing commercial relationships generate familiarity with a counterparty’s financial condition. The defense may rebut by demonstrating that the relationship, while commercial, lacked the duration, intensity, or character necessary to impute such knowledge.

VII. The Prior Obligation Defense

A. Doctrinal Foundation

A conveyance executed in performance of a pre-existing legal obligation generally falls outside the ambit of fraudulent transfer liability. The rationale is straightforward: a debtor who discharges a binding duty acts under legal compulsion rather than voluntary choice, and such compliance with law cannot constitute actionable fraud upon other creditors.

B. Illustrative Applications

Preliminary Contracts. Where a debtor conveys property pursuant to a preliminary agreement conferring upon the counterparty an enforceable right to demand conclusion of the principal contract, the subsequent conveyance merely effectuates a pre-existing obligation. The temporal reference point for assessing the transaction’s propriety shifts to the date of the preliminary agreement.

Revocation of Gifts. A reconveyance of donated property following valid revocation of the gift for cause (such as gross ingratitude) constitutes performance of a statutory obligation arising by operation of law, not a volitional transfer subject to avoidance.

Judicial Decrees. Compliance with court orders—whether requiring specific performance, partition, or other disposition of assets—cannot ground fraudulent transfer liability absent extraordinary circumstances suggesting collusion in procuring the order.

C. Limitations

This defense applies with full force only where the underlying obligation arose independently of the debtor’s volition or predated the creditor’s claim. Where the debtor voluntarily assumed the obligation after incurring the creditor’s debt, and did so with awareness of creditor prejudice, the defense may prove unavailing.

VIII. The Statutory Escape Valve: Alternative Satisfaction Under Article 533

A. The Doctrine of Substituted Performance

Even where the defendant cannot defeat liability on the merits, Article 533 provides a mechanism for avoiding the practical consequences of an adverse judgment. The transferee may discharge the obligation to the creditor by either:

- Satisfying the creditor’s claim against the debtor (up to the value of the benefit received); or

- Identifying debtor assets sufficient to satisfy the creditor’s claim.

B. Requirements for Asset Identification

The second alternative requires more than vague assertions of debtor solvency. The defendant must specify particular assets that are (i) identifiable with reasonable precision, (ii) of sufficient value to satisfy the creditor’s claim, and (iii) actually amenable to execution. Property that is exempt from execution, already fully encumbered, or practically unreachable does not satisfy this standard.

C. Economic Rationality

This remedy proves particularly attractive where the value of the transferred asset substantially exceeds the creditor’s claim. A defendant who received property worth one million złoty to secure a debt of two hundred thousand złoty may rationally prefer payment to forced liquidation at execution sale prices.

IX. Procedural Dimensions of the Defense

A. Responsive Pleading Obligations

Polish civil procedure imposes strict timelines for defensive pleadings. The defendant ordinarily must file a response within fourteen days of service, though courts possess discretion to extend this period. Dilatory practice carries severe consequences: untimely assertions may be stricken, and failure to deny specific allegations may result in deemed admissions.

B. Burden of Proof Architecture

The creditor bears the burden of establishing all prima facie elements of the actio Pauliana. The statutory presumptions of Articles 527 § 3 and § 4 shift to the defendant only the burden of rebutting transferee knowledge—not the burdens associated with other elements. Defense counsel should resist prosecutorial overreach that would impose upon the defendant evidentiary obligations properly belonging to the creditor.

C. Provisional Measures

Creditors routinely seek preliminary injunctions prohibiting alienation or encumbrance of the disputed property. Such orders, while interlocutory, impose significant constraints upon the defendant’s dominion. Prompt appellate challenge may be warranted where the underlying claim appears deficient or the balance of hardships favors the defendant.

X. Common Defensive Errors and Their Avoidance

Experience teaches that certain recurring missteps undermine otherwise meritorious defenses:

Procedural Default. Passive defense—whether through failure to appear, failure to file responsive pleadings, or mere general denial—virtually guarantees adverse judgment. The court will accept uncontested creditor allegations as established.

Waiver of Limitations. Because the five-year bar of Article 534 must be affirmatively pleaded, counsel’s oversight in raising this defense forfeits what may be the clearest path to complete vindication.

Misallocated Emphasis. Defendants frequently expend disproportionate effort challenging their own knowledge while neglecting more fertile ground: the creditor’s failure to establish prejudice, the invalidity of the underlying claim, or the debtor’s lack of fraudulent intent.

Post-Complaint Transfers. Disposing of the disputed asset during litigation does not extinguish liability; it merely complicates matters while potentially exposing the defendant to additional claims sounding in tort or criminal liability.

XI. Settlement Considerations

Not every case merits litigation to judgment. Where the creditor’s evidence appears strong and defensive prospects dim, early settlement may conserve resources and provide certainty. Negotiated resolution often yields terms more favorable than those obtainable through compulsory execution—including extended payment schedules, partial forgiveness, or structured arrangements that preserve the defendant’s essential interests.

The decision to settle requires clear-eyed assessment of litigation risk, transaction costs, and the defendant’s risk tolerance. Counsel’s obligation encompasses providing candid evaluation rather than encouraging fruitless resistance.

XII. Conclusion

The actio Pauliana, for all its historical pedigree and continuing vitality, is not self-executing. The creditor must carry substantial evidentiary burdens; the defendant who understands these burdens possesses meaningful opportunities for successful defense. From the threshold limitations inquiry through the nuanced analysis of prejudice, knowledge, and prior obligation, each element of the creditor’s case presents a potential point of failure.

Effective defense requires early engagement, thorough factual investigation, and strategic selection among available theories. The passive defendant invites adverse judgment; the proactive defendant may well prevail. Where complete defense proves unattainable, the statutory safety valve of Article 533 provides a mechanism for mitigating loss, while early settlement may serve interests that continued litigation cannot.

The prudent transferee, confronted with an actio Pauliana complaint, should approach the matter not with resignation but with the recognition that the burden of proof lies with the adversary—and that burden is by no means light.